The shopping list of the biotech/medtech CFO

Life hazards, companies without any turnover, fragile organizations: insurers don’t like lifescience firms! All the more reason to get organized …

1 What type of liability insurance?

The “medical” liability insurance of a medtech or a biotech must be carried by a specialized company, able to take into account the specific risks of the sector (raw material handled, laboratory conditions, medical devices in contact with the human body …):

Chubb, CNAHardy, HDI, QBE, AXA XL, Allianz AGCS, …

Product liability covers the financial consequences of marketing a defective product. As long as the biotech has not begun a phase-3 trial or a commercialization phase, it can probably limit itself to a much cheaper general liability policy.

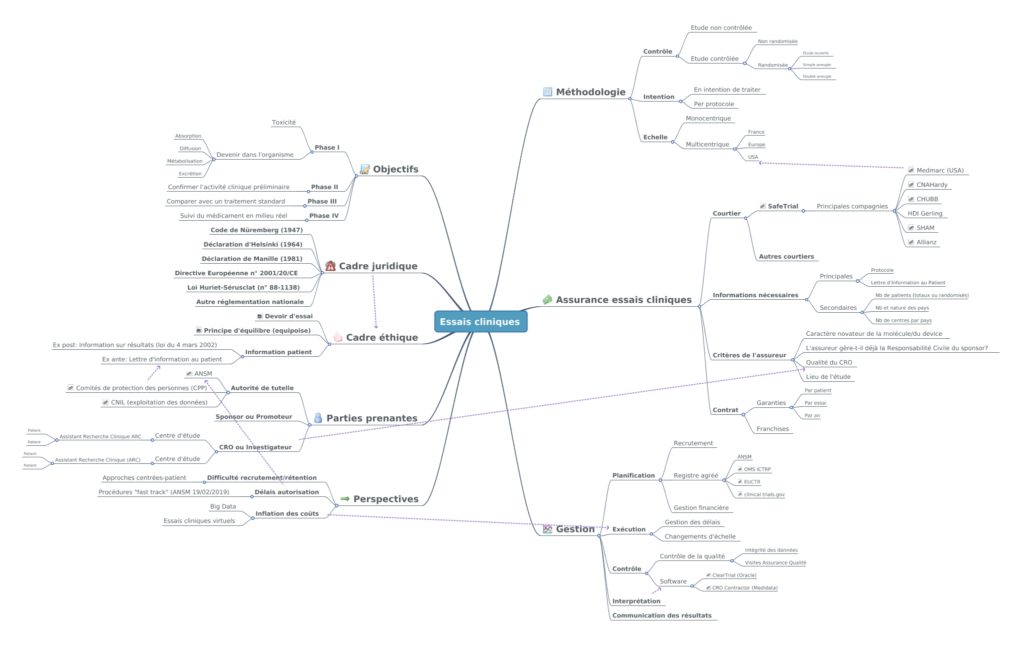

2 Are we ready for t our future clinical trials?

Mandatory or required by ethics committees, clinical trial insurances are difficult to get, expensive and vary from country to country. They must stick to the evolution of the protocol. You will be better off hiring a specialized broker, who will select companies offering solutions regardless of the test country and provide certificates within short notice.

3 Are our premises properly insured?

Property insurance seems a trivial matter. However, biotech or medtech firms often share part of their premises (with a university, in an incubator, etc.). Sometimes they share their equipment or conversely use foreign property. Your insurer has to be informed and the policy adapted.

4 Are our key equipments insured, and how?

Key harware (HPLC, microscope, etc.) is expensive and valuable.

Especially when it is leased, it must be properly insured via a Boiler & Machinery policy (which, moreover, covers them for hazards called “internal breakdowns”).

5 Do we have a Cyber coverage?

Viruses and other network intrusions can cripple business, causing it to fall behind, and most importantly, lead to the loss of research data, or the leakage of sensitive or confidential information.

Biotech / medtech can protect themselves with a cyber insurance policy, even if it is not easy to obtain in this industry.

6 How to insure our new American branch?

Funding, trials coordination, research, …: Very soon, start-ups are tempted to gain a foothold across the Atlantic. Property & Casualty insurance in the US has nothing to do with French insurance concepts. Besides, traditional French insurers are often unable or unwilling to extend their guarantees to US operations. In addition, there is the obligation to have a local US broker. However, solutions exist, allowing for a more secure global contract.

7 What about employees working abroad or traveling?

Subsidiary, congress, meeting, …: managers and researchers are called upon to move. Please secure these 3 aspects:

-their civil liability abroad (incidents of all kinds)

-their health costs (in the event of illness or accident in a country without extensive social security)

-their possible repatriation (in the event of illness or family problem)

8 What about group insurance plans?

From the 1st employee, medtech or biotech must in French legally offer:

– collective pension schemes (guarantees in the event of death, sick leave, disability)

– group health insurance (reimbursement of health expenses)

to all its employees (and by considering the many special cases: long-term interns, doctoral students, staff made available by others, etc.).

If the company depends, which is often the case, on the Collective Pharmacy Agreement (CCN 176), the guarantees to be respected are wide and difficult to get from traditional companies.

9 What about the business owner?

Often the founder, the boss of biotech / medtech is on all fronts.

He should buy several tailored insurance tools:

– the job loss insurance (because, as a CEO, he will not get unemployment benefits)

– loan insurance, if he has to raise funds himself, in the initial phase

– key person insurance, which allows him for example to hire an interim manager if he is in bad condition

– his personal insurance (“prévoyance”), for the benefit of his family

– a D&O (Directors & Officers) insurance, in case he, as the manager, is sued.

10 Can we increase the confidence of our investors ?

They put money into the business, they want to make sure it will not spin out of control!

Investors will scrutinize whether the guarantee limits of the policies described above in point 9 are sufficient.

Moreover, in the event of an IPO (Euronext, Nasdaq), they will demand robust policies, with comfortable amounts, suitable clauses, underwritten by top-tier companies and able to protect themselves as board members.

Conclusion:

Lifescience is not just about pipeline and raising money.

Insurance management can prevent delays in clinical trials, make funders more confident, and help manage hazards.